Making Tax Digital is the UK Government’s initiative to “make it easier for individuals and businesses to get their tax right and keep on top of their affairs.”

The goal is to make the UK’s tax infrastructure as digital as possible. It is hoped that this will make HMRC’s tax system more efficient, effective and easier to use and navigate for businesses.

Making Tax Digital entails swapping your accounts and tax from paper records to online, digital records. The idea is for as many businesses and sole traders as possible to go completely paperless with their accounts and tax.

Making Tax Digital is split into the following phases:

- Public Testing of Making Tax Digital for Income Tax (April 2025)

- Making Tax Digital for Income Tax Self-Assessment goes live from April 2026 for individuals with qualifying earnings Over £50K.

- Making Tax Digital for Income Tax Self-Assessment goes live from April 2027 for individuals with qualifying earnings Over £30k

- Making Tax Digital for Corporation Tax – To be confirmed.

So, how will Making Tax Digital affect dentists?

Samera have been my accountant for 7 years and have continued to provide me with accurate accounts and timely submissions. Their digital workflow eases the management of receipts and filing. I have found them to be supportive and knowledgeable particularly during the recent crisis. Thank you.

Five stars

Making Tax Digital for Dentists

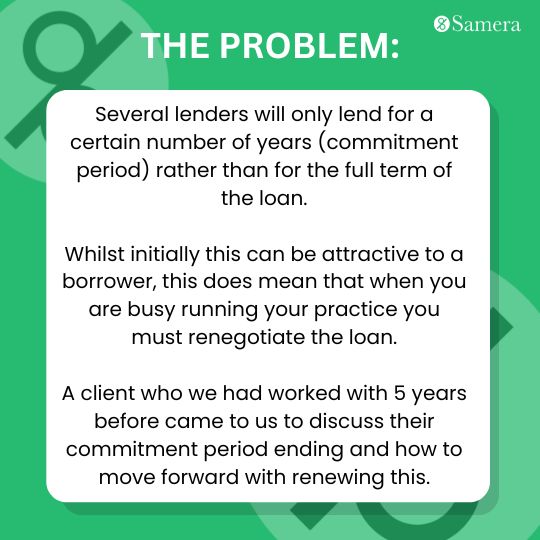

On 6th April 2026 Self Assessment tax payers will need to abide by the Making Tax Digital for Income Tax regulations.

These new regulations in 2026 will only apply to Self Assessment taxpayers who file a taxable income above £50,000 a year. As an Associate dentist, you almost certainly will.

Click here to listen to our podcasts on how dentists can reduce their tax bill.

From 6th April 2026, you will have to use digital software to hold and process digital records of your accounts and tax. Paper records of your accounts and tax will no longer be allowed by law. A public testing of this commences from April 2025.

The software you use to hold and process your digital records must be Making Tax Digital compliant.

You can find a list of compliant software on the .gov.uk website here.

Your Self Assessment tax return will also change. You will instead be required to submit 5 reports throughout the year. These are, 4 quarterly summaries of your accounts, as well as an end-of-year report.

The dates you will be required to submit these returns are:

- 5th August

- 5th November

- 5th February

- 5th May

The end of year return must be filed by 31st January after each relevant tax year. Your tax bill will also need to be paid by 31st January following the relevant year, but you will be able to make tax payments throughout the year if you wish.

You can find out more about accounts and tax for dental associates here.

Making Tax Digital for Dental Practices

Currently MTD will apply to practices that trade as sole traders and earn over £50k from April 2026. Again we are recommending our clients enter the public trial and we will be implementing this with our client base. This is subject to eligibility so check with us or HMRC.

For those practices that trade as companies, we are still awaiting a date when MTD applies for corporation tax.

You can sign up to the scheme early voluntarily, no matter your taxable turnover. This may be worth doing, in only to give yourself more time to get used to the new process.

Click here to watch our webinar on using Xero and Hubdoc for your dental practice accounts.

It is also required that your practice uses digital accounting software that is compliant with Making Tax Digital, such as Xero. You will need to keep your digital records for 6 years.

You can find a list of compliant software on the .gov.uk website here.

Making Tax Digital With Samera

At Samera we no longer accept paper records for our accountancy clients. All accountancy and tax records need to be in digital format.

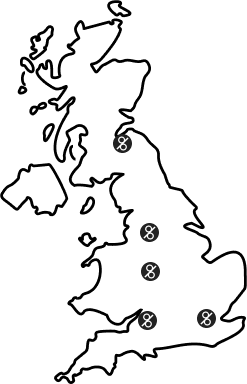

We only use software that is compliant with the Making Tax Digital scheme. We are a Xero Gold Partner and have been pioneering digital accountancy for dentists for years.

When you go digital with our dental accountants, your accounts and tax are received, processed and stored safely, securely and easily.

All you need to do is scan your receipts and invoices, upload them to Hubdoc and we will do the rest!

The process is quick, simple and safe – which means you save time, effort and money.

Making Tax Digital FAQs

What is Making Tax Digital (MTD)?

MTD is a government initiative aimed at modernizing the UK tax system. It requires certain individuals, including self-employed dentists and property landlords, to:

- Submit tax updates to HMRC using compatible software.

- Keep digital records.

Does MTD apply to dentists?

Yes, if you’re a self-employed dentist or a landlord earning above the MTD thresholds, you will need to comply.

However, NHS-employed dentists may not need to comply unless they also have private practice or property rental income above the threshold.

What are the income thresholds for MTD ITSA?

- April 2026: Gross income from self-employment or property over £50,000.

- April 2027: Gross income over £30,000.

- Future plans: May apply to those earning over £20,000, but no date is set.

What do dentists need to do to comply with MTD ITSA?

Digital Record-Keeping:

- Use MTD-compatible software to keep records of all income and expenses.

- Ensure this software can interact with HMRC’s system.

Quarterly Updates:

- Submit income and expense updates every 3 months through the software.

End-of-Year Finalization:

- At the end of the tax year, submit a final declaration confirming your tax position.

What software do dentists need for MTD?

You must use MTD-compatible software or spreadsheets linked to HMRC systems. Common software for dentists includes:

- QuickBooks

- Xero

- FreeAgent

Check that your software can handle MTD ITSA requirements.

Are there exemptions for dentists?

Dentists may qualify for exemptions if:

- It’s not reasonably practical to use digital tools (e.g., age, disability, or remote working conditions).

- HMRC grants a specific exemption.

You can apply for an exemption by contacting HMRC.

What happens if dentists don’t comply with MTD?

Failure to comply can result in:

- Interest on underpaid taxes due to non-compliance.

- Penalties for late or missed submissions.

How can dentists prepare for MTD ITSA?

- Review Income Sources: Check if your total gross income exceeds the threshold.

- Upgrade Your Systems: Invest in MTD-compatible software.

- Work With an Samera: We specialise in accounts and tax regulations for dentists. Book a free consultation with our team to find out how we can help you prepare.

What is the timeline for submitting MTD ITSA returns?

Quarterly submissions:

- For example: Q1 (April–June) updates are due in July.

Final Declaration:

- Due by the following January (e.g., for 2026–27, due January 31, 2028).

Do dentists with rental property income need to include that in MTD ITSA?

Yes. If your gross rental income combined with self-employment income exceeds the threshold, you must report both under MTD ITSA.

How is other income reported under MTD ITSA?

Income from employment, pensions, or investments is not reported quarterly to HMRC under MTD ITSA.

It is reported annually as part of the finalization process, similar to the current self-assessment tax return.

Ways to report other income under MTD ITSA:

- Using HMRC’s new online interface being developed to replace the current self-assessment system.

- Using MTD ITSA software with additional functionality for other income.

- Using other tax software (e.g., upgraded commercial self-assessment software).

What happens if your turnover/gross income drops below the threshold?

A taxpayer can leave MTD ITSA if their turnover or gross income falls below the threshold for three successive tax years. The exemption can be claimed starting from the next tax year after meeting this condition.

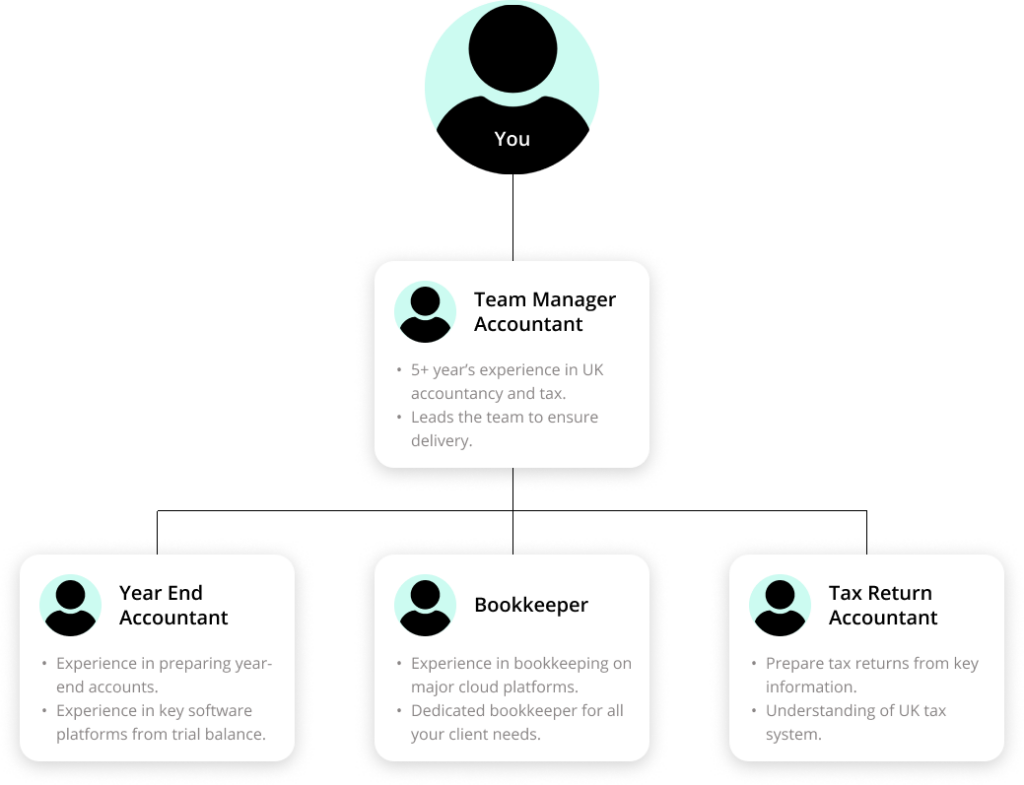

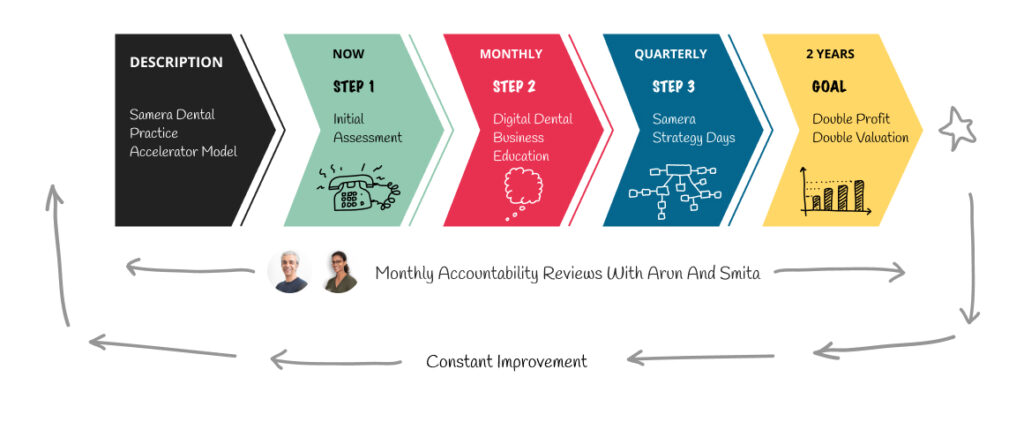

Dental Accounts & Tax Specialists

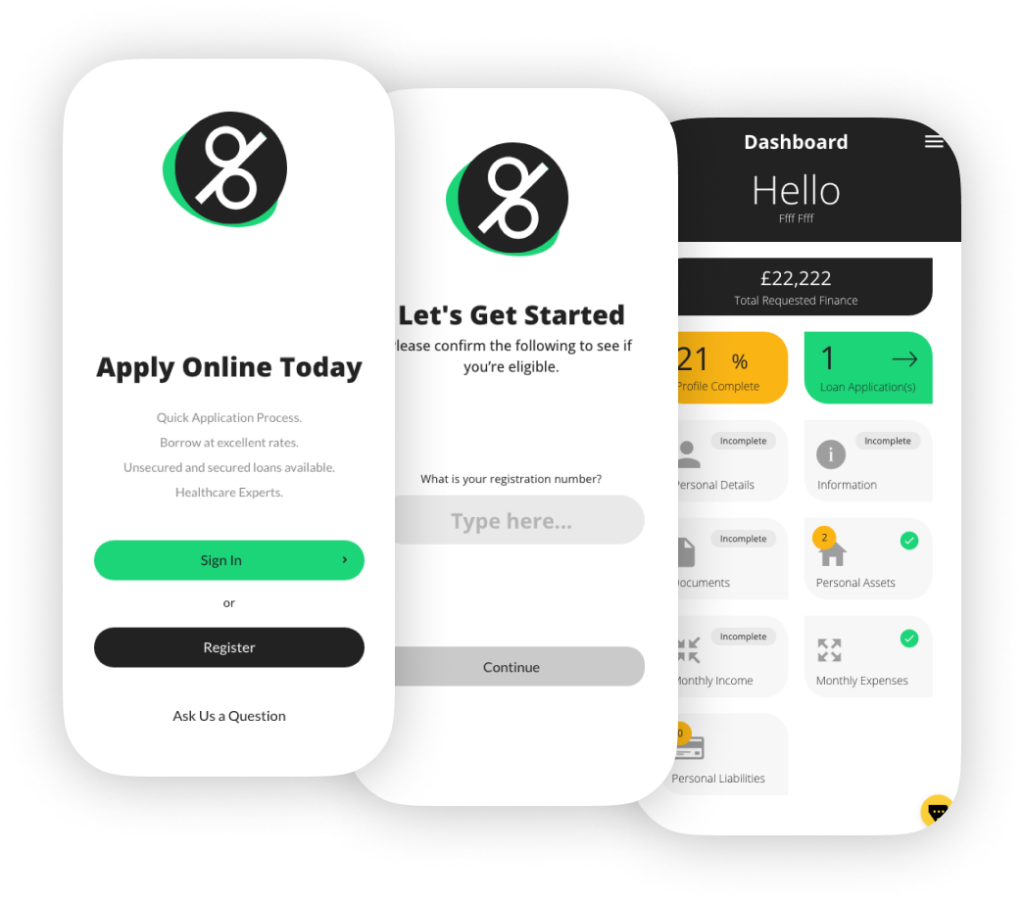

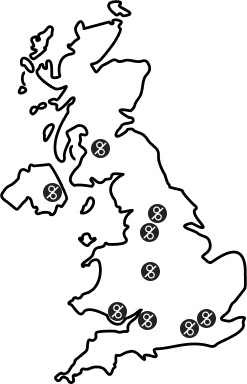

As dental practice owners ourselves, we know what makes a clinic tick. We have been working with dentists for over 20 years to help manage their accounts and tax.

Whether you’re a dental associate, run your own practice or own a dental group and are looking to save time, money and effort on your accounts and tax then we want to hear from you. Our digital platform takes the hassle and the paperwork out of accounts.

To find out more about how you can save time, money and effort on your accounts and tax when you automate your finances with Samera, book a free consultation with one of our accounting team today.

Dental Accounts & Tax: Further Information

For more articles, webinars and blogs on dental accounts check out the dental accountancy section of our Learning Centre and follow us on YouTube, Facebook and Instagram.