or

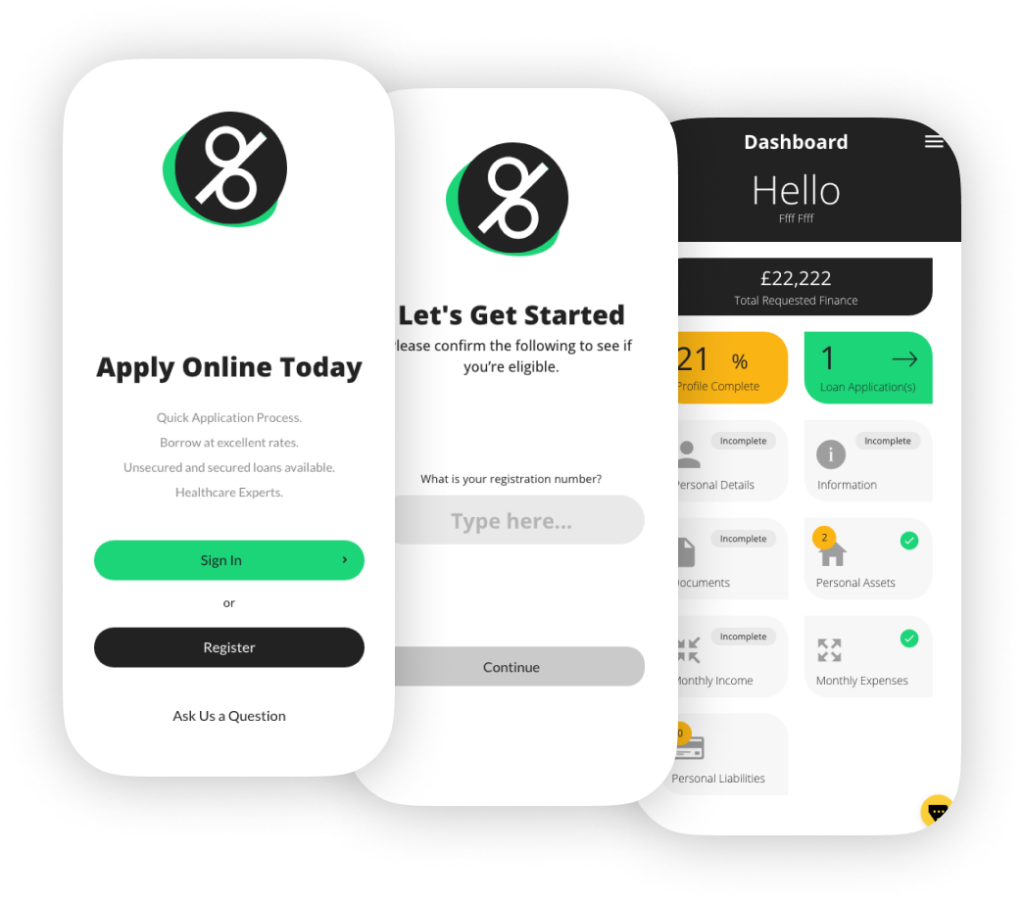

Apply on our app for a faster

and simplified application process.

Sign Up

Sign up with the Samera Finance app.

Complete Profile

Fill in all of the relevant information.

Get Approved

Get approved with the most competitive interest rates out there.

How much could you save?

If you are seeking finance for your dental, pharmacy, vet or healthcare business, Samera Finance can assist you in securing the right loan on the best finance terms using our extensive years of banking and financial experience in the healthcare sector. All or team are experienced ex-healthcare bankers.

Samera Finance works with lenders across the whole UK market and we can ensure you get a finance deal that is right for you. We have found the lowest interest rate being offered is not always the best deal available, as there may be other conditions of the loan that do not suit your needs.

Simply sign up, let us know some key information and once your application is completed and approved, we’ll get to work finding you the right business loan (facilities) for your healthcare business. The process is easy, quick and secure so apply now to start, buy or grow your business.

Debt refinancing with Samera

As you can see in the example below, a small change in the interest rate being paid – 1.6% in this instance, is saving this client over £170,000 over the term of the loan. If you have debt and are paying 3% plus above base rate, do get in touch, we can assess your specific situation and if appropriate help you save on the cost of borrowing.

| Existing Loan | Refinanced Loan |

|---|---|

| £800,000 | £800,000 |

| Term 20 years | Term 20 years |

| Rate 4% (plus base) = 6.25% | Rate 2.4% (plus base) = 4.65% |

| Monthly repayments = £5844 | Monthly repayments = £5196 |

| Total repayments = £1,403,520 | £1,230,240 |

| Savings | £173,240 |

Speak to an expert

Book a virtual consult with

Nigel

Book a virtual consult with

Dan

“It took only days to get the finance in place and furthermore Nigel Crossman has gone over his remit in helping me along the process with valuable advice that saves me much time and money! Basically if you want a result call Samera!”

“Great service, really paid attention to our needs and offered us the appropriate advice. In particular we were impressed with the time, dedication and focus given to help us finance our acquisition of a dental practice with good rates. We also managed to stay in communication during unsociable hours which really made the process convenient for us. Very helpful.”

“Very quick to get me the finance I had struggled for several years to get. I will definitely be using this service again in the future!”

More on healthcare finance

-

Samera Finance

Apply online today for your healthcare business. Quick Application Process. Borrow at excellent rates. Unsecured and secured loans available. Healthcare Experts.

-

Acquisition Finance

You need to ensure that you get the best finance deal available in the market when investing in your own business.

-

Refinancing

We tend to review our car and house insurance costs on a regular basis but seldom look at the costs of our borrowing.

-

Property Finance

There are many different products available to finance commercial property purchase and development.

-

Asset Finance

We can help find you the best price and the right terms for your business. We do not charge you for sourcing asset finance.

-

Financial Health Check-up

It’s time for your financial health check-up, we will analyse your spending and cash flow to identify the areas where we can save you money.

Become a partner

-

Suppliers and Partners

By working with Samera, you can ensure your clients get the finance they need, when they need.

FAQ’s

Do you have further questions?

If so, please send us a message via our contact form.

How do I apply?

All you need to do is sign up and fill in the required forms. The process is quick, streamlined and only takes a matter of minutes. Once we have assessed and approved your application we will get to work sourcing the best business loan for you.

What is a healthcare business loan?

A healthcare business loan is finance that a healthcare business borrows to fund the start, running or growth of their business, such as for buying equipment and assets to aid their business.

A personal loan can be used for non-business purposes such as purchasing a new home or maintaining a car, but not for business purposes.

A business loan allows you to borrow money from financial lenders and use the money for purely business-related costs and projects.

What different kinds of healthcare business loans are there?

There are several different forms of business loan available to your healthcare business. Which business loan is right for you will depend on factors such as what you need the loan for and your ability to repay it.

These are some of the different options available to you:

Acquisition finance:

Acquisition finance funds the purchase of an existing business or shares in a business. Whether you want to buy your first healthcare business, buy shares in an existing business or buy a second business, you will most likely need to borrow acquisition finance.

Asset finance:

Asset finance is a business loan raised to fund the purchasing, renting or maintenance of business assets like equipment or any other assets that help your business function, such as vehicles.

Refinancing:

Sometimes you can get more favourable terms on your loans by refinancing the debt. This means that you can renegotiate factors such as the interest rate or the payment schedule by taking out a new loan with better terms to cover the old one.

Commercial mortgages:

A commercial mortgage is simply a mortgage used to purchase a commercial property, like the site for a new healthcare clinic or a new premises for your business. Commercial mortgages can be repaid over 15/20/25 years and allow you to spread your payments over the life of the business.

Sometimes, an unexpectedly heavy tax bill can create a huge hit in your working capital. When this happens, it can be better to spread the cost of your tax bill over the year with a tax loan. This loan covers the immediate bill and allows you to pay in smaller, monthly instalments.

Working capital and cash flow loans:

When your working capital takes a hit, your cash flow can be reduced drastically. When you have to dip into your working capital for an unexpected purchase, it may be best to borrow the money instead. This way you can spread the cost across the year, rather than taking it all out of the working capital in one go.

How does taking out a business loan work?

When you take out a business loan for your healthcare business, you borrow the money in a lump sum and pay it back in instalments (plus interest payments). This allows you to make purchases you otherwise would not be able to afford, and also spread that cost over a longer period of time.

Loans are usually either paid back over a short term (2 years or less) or long term (3 years or over).

You also have the option in many cases to borrow a secured or unsecured loan. A secured loan is one which you guarantee with collateral. What this means is that you borrow the money against the value of an asset the business owns, such as a property. If you fail to repay the loan the lender will take the asset to recoup their loss. An unsecured loan does not require collateral, however, they usually come with less favourable terms. This is because the risk to the lender is greater.

Am I eligible for a healthcare business loan?

To find out if you are eligible to take out a business loan, simply click ‘apply now’, fill in a few forms and we’ll let you know how much you could possibly borrow. Any loan is, of course, dependent on the business having the ability to meet the payments

Lenders, such as the banks, like lending to healthcare businesses. Get your applications, your financial forecasts and your business plan right and we can help you find the right business loan for your healthcare company.

What information will I need to provide to the lender?

Lenders will want to see a range of information and documentation. It is essential that you get this step correct. The lenders will reject your application if the projections are wrong, the business plan is poorly done, you have a poor financial record, and that’s just a few reasons.

The banks will want you to be able to provide evidence of:

- Your previous earnings in your healthcare field.

- How you handle personal finances.

- Your living situation, whether you own or rent your home.

- Career in healthcare so far and any management experience.

- Ability to repay any loan.

- Personal savings

- Tax payment records.

To find out more about making sure your loan application is successful, click here.

I’ve been denied a healthcare business loan before, can I still apply?

If you have had a business loan application rejected in the recent past, you may need to improve your credit rating and financial standing before you can reapply. Or, it may be that you were not talking to the right people! You may need to approach alternative lenders or adjust your application and business plan. Contact us today to find out how to improve your chances of applying for a business loan.

How easy is it to take out a healthcare business loan?

Applying for a healthcare business loan is not always an easy business. Even when it is, there’s no guarantee that the loan you take out is the best available.

To make the process easier, increase your chances of a successful application and ensure you get the best deal around, we have created the Samera Finance app. We have been working in the healthcare finance market for decades. We know how to format your application, who to approach and how to negotiate the best deal, thanks to our extensive experience and contacts.

Applying for a business loan for your healthcare business is easy when you use Samera Finance to do the hard work for you.

How much can I borrow for my healthcare business?

The amount you can borrow will depend on a wide range of factors. These include your ability to repay the loan, what you intend to use the money for and your current financial situation.

Samera Finance can help source loans to cover small purchases for consumables and small assets, as well as larger loans to purchase property or another business.

Use our finance calculator above to see how much you can borrow.

What information will I have to provide when I apply?

The information we require will vary case by case, depending on what kind of loan you need and what you intend to use it for.

This is a basic list of the kind of information we will require:

Personal

- Personal Profile Form – details income and expenditure

- Personal Banks Statements – last 6 months

- Last 3 years associate accounts

- CV

Business

- Last 3 years practice accounts

- Practice Management information – if available

- Practice sales particulars

- Business plan

- Projections may be required

What is the interest rate for a healthcare finance business loan?

The interest rate you get will vary case by case, as well as varying between the different lenders too.

The average interest rate for a healthcare business loan is typically around 2.85% – 3% for a purchase. However, Samera Finance can help negotiate the interest rate to make sure you get the best price available.

How soon will I need to start repaying the loan?

When you need to begin repaying your healthcare business loan will depend on the terms of your loan agreement. In many cases, you will need to start repaying the next month after receiving the money. However, we may also be able to negotiate a repayment holiday, where you have a grace period of around 6-12 months before you need to begin repayment.

How long will I be repaying my business loan?

The payment schedule for your loan is known as the term length. The term length will depend on what you negotiate in the application, as well as the kind of loan you are borrowing.

Some loans, such as bridging loans, are repaid within 12 months. Other short term loans will be repaid within 2 years. Long term loans over a period of longer than 3 years.

Remember that it is often the case that the longer the term length, the lower the interest rate you will pay.

What is a fixed interest rate loan?

A fixed interest rate means that the interest rate will remain the same throughout agreed period of the fixed-rate repayment schedule. Therefore, if the Bank of England base rate rises, your payments will not be affected – since your interest rates are fixed. This means you can more easily budget your cash flow, knowing these payments remain fixed.

However, this does also mean that your interest rates will remain the same if the Bank of England base rate falls.

What is a variable interest rate loan?

A variable interest rate is one that can fluctuate according the to Bank of England base rate . This means that if the Bank of England base rate falls or rises, so too will your loan interest rate.

Although this can sometimes mean your interest rates fall, it also makes your payment schedule hard to predict.

If the Bank of England base rate rises unexpectedly, you may find yourself with an unexpected hit to your cash flow.

Does Samera Finance lend money?

No, we are not a financial lender. Samera Finance is a commercial finance broker. That means that we use our network and connections within the UK healthcare lending industry to find the best loans and negotiate the best terms.

We find the right finance, make sure your application is right, negotiate the terms and ensure you get the best loan for the right price.