In this webinar, we take you through what you need to know about refinancing and restructuring your debts and finance.

Most dental practices have debts and loan obligations and some struggle to meet them. Yet, there are ways to overcome these challenges and thrive financially. Refinancing and restructuring debts can really help dental clinic owners manage their finances, but you need to understand how it works and where to begin. Here, we’ll see how refinancing and restructuring debts can benefit your clinic, the steps to start the process, and what you need to know. We’ll also share some tips to help you achieve financial stability and success.

Understanding the Challenges Faced by Dental Practices

Dental clinics face significant financial challenges due to tough competition, rising costs, and evolving industry standards. Keeping up with changing NHS regulations and the shift towards private dental care requires investments in equipment, technology, and staff training.

On top of this, most dental practice owners need to borrow money to buy or set up their dental practice in the first place.

Moreover, clinics can struggle to retain existing patients and attract new ones amidst fierce competition, necessitating expensive marketing strategies and maintaining patient satisfaction. The high operational costs, including rent, bills, insurance, and staff salaries, further strain clinic finances, compounded by the need for continuous training and adherence to hygiene standards.

How to Assess Your Current Financial Situation

Before tackling debt refinancing or restructuring, it’s crucial to get a clear picture of your dental practice’s financial health. This is the foundation for making informed decisions about managing your debt.

- Gather Your Financial Documents: Start by collecting key financial documents like balance sheets, income statements, and cash flow statements. These will show you your recent performance and give you a snapshot of your practice’s financial health.

- Analyse Your Financial Strengths and Weaknesses: Review these documents carefully to identify areas where your practice is doing well and areas that need improvement. Look for trends or patterns that might affect your debt management strategy.

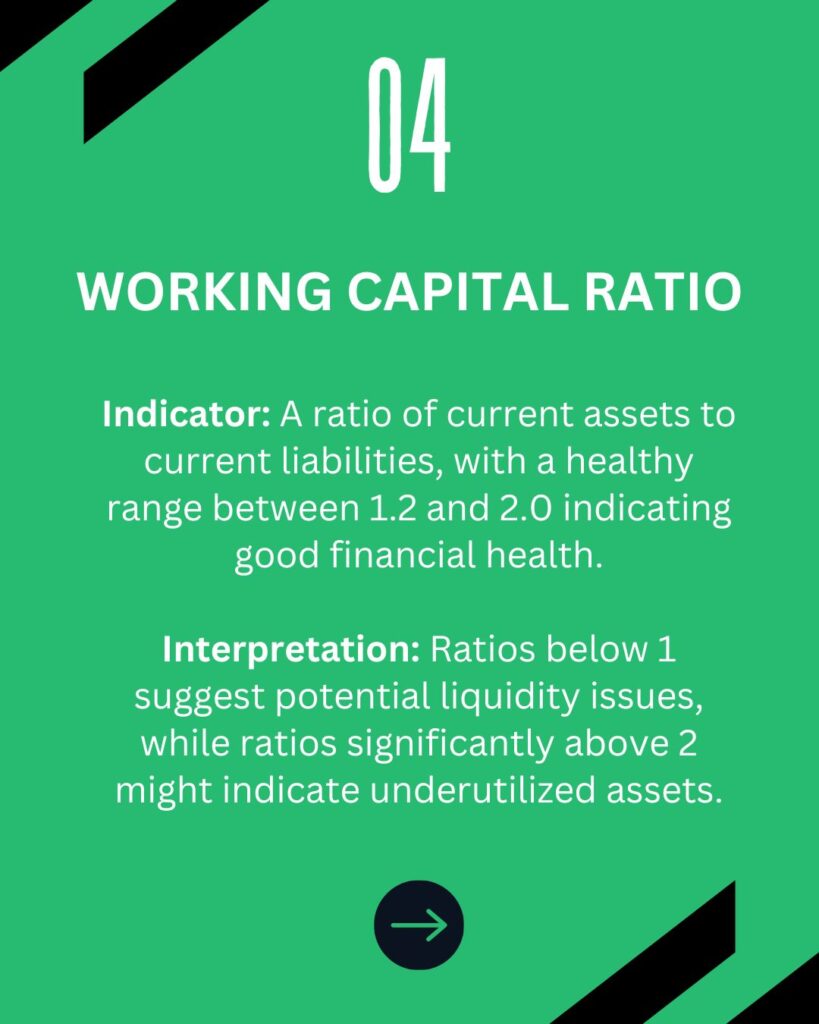

- Financial Ratios: Measuring Your Practice’s Health: Financial ratios like the debt-to-equity ratio, current ratio, and debt service coverage ratio can tell you a lot about your practice’s financial health. These ratios measure factors like your ability to meet debt obligations, cover short-term liabilities, and manage overall debt levels.

- Cash Flow Management: Keeping Track of Inflows and Outflows: Understanding your cash flow allows you to proactively manage incoming and outgoing funds. This helps ensure you have enough cash available to cover expenses and debt payments. You will also be able to more easily identify areas you can save money, and where you may need to spend a little more.

- Get Expert Help: Consider consulting a financial advisor or accountant like Samera with experience in the dental industry. They can help you interpret your financial data, identify areas for improvement, and make informed decisions about debt restructuring and refinancing.

- Benefits of Understanding Your Finances: By getting a thorough understanding of your practice’s financial situation, you’ll be well-equipped to make smart decisions about debt management. This paves the way for financial success and the long-term stability of your dental practice.

Click here to read our article on 11 Top tips to manage your cash flow in a crisis

Debt Restructuring vs. Refinancing: Understanding Your Options

When it comes to managing dental practice debt, you have two main options: restructuring and refinancing. Here’s a breakdown of each strategy:

Debt Restructuring:

- Think of it as a negotiation: Debt restructuring involves working directly with your existing lenders to modify the terms of your current loans. This could involve extending repayment periods, reducing interest rates, or even forgiving a portion of the debt in exchange for a lump sum payment.

- Benefits: Restructuring can significantly reduce your monthly debt payments, improving cash flow and freeing up resources for other needs. It can also simplify your debt by consolidating multiple loans into a single one.

- Considerations: Restructuring may not always be an option, depending on your lender and your financial situation. It’s important to negotiate effectively and have a clear understanding of your desired outcome.

Debt Refinancing:

- Taking out a new loan to pay off old ones: Debt refinancing involves securing a new loan with more favorable terms than your existing debt. This new loan is then used to pay off your existing ones, resulting in potentially lower interest rates, longer repayment periods, or both.

- Benefits: Similar to restructuring, refinancing can free up cash flow and simplify your debt management. However, refinancing often comes with additional fees associated with the new loan.

- Considerations: Qualifying for a new loan may require good creditworthiness. Carefully compare interest rates and fees associated with refinancing to ensure it’s truly beneficial.

Choosing the Right Option:

The best approach for your dental practice depends on your specific financial situation and goals. Consider factors like the interest rates on your existing loans, your creditworthiness, and your desired monthly payment amount. Consulting a financial advisor experienced in the dental industry can help you assess your options and choose the strategy that best suits your needs.

The Potential Impact on Cash Flow and Profitability

When thinking about refinancing and restructuring debt, it’s important to understand how these actions can affect your income and profitability, making sure they support the long-term success of your practice.

Refinancing debt can directly affect your income by lowering your monthly payments through better terms like lower interest rates or longer repayment periods. This frees up money that can be reinvested back into your business.

On the other hand, debt restructuring involves changing your existing obligations to create a more sustainable financial setup. This might mean combining loans, renegotiating terms, or extending repayment schedules to better manage your finances and reduce the risk of default.

It’s essential to evaluate how these changes might impact your profitability. By reducing interest costs through refinancing and restructuring, you can directly improve your profitability. Having more cash on hand from these strategies allows you to invest in growing your practice, and marketing efforts, and attracting more patients, ultimately leading to increased profitability over time.

Dental practice owners should carefully consider how these changes could affect their income and profits, seeking advice from industry experts and financial advisors to make informed decisions and implement effective financial strategies. By making smart choices and managing finances proactively, dental practices can achieve their full potential for financial success and steady growth.

Important Considerations and Potential Risks

When renegotiating and restructuring debt for dental practices, it’s crucial to carefully consider potential risks and be fully aware of the implications. While these methods can help ease financial burdens and improve cash flow, they require careful planning and understanding.

Understanding how these changes can affect your credit rating is essential. Altering debt arrangements can impact credit scores, affecting your ability to borrow in the future and conduct financial transactions. Consulting with financial advisors or credit experts can help minimize any negative effects.

It’s also important to look at the long-term financial consequences. While restructuring may offer immediate relief, it’s essential to analyze the overall costs, interest rates, and repayment terms of any new agreements.

Variable interest rates come with inherent risks, so it’s crucial to assess your risk tolerance and ability to handle potential fluctuations.

Managing relationships with existing creditors delicately is imperative. Debt restructuring may strain these relationships and be seen as a sign of instability. Open and transparent communication with creditors is essential to maintain understanding.

Compliance with legal and regulatory obligations is a must. This highlights the need for legal and financial expertise to navigate complexities effectively.

In summary, while debt renegotiation and restructuring can be beneficial for dental practices, thorough assessment, expert guidance, and proactive communication are essential for confidently navigating these strategies and fostering sustainable growth.

The Benefits of Refinancing and Restructuring Debt

Refinancing and restructuring debt offer significant opportunities for dental clinics to attain financial stability and success. One major benefit is the potential to secure lower interest rates through refinancing, which reduces monthly payments and overall interest expenses. Extending repayment periods can also ease immediate financial pressures, allowing clinics to invest in necessary upgrades and marketing efforts, ultimately boosting long-term profitability.

Debt restructuring complements refinancing by renegotiating existing agreements for improved repayment terms, such as lower monthly payments or extended durations. Consolidating multiple loans into one simplifies financial management and reduces the risk of missed payments or late fees, providing clarity on debt obligations.

Furthermore, these financial strategies contribute to enhancing the clinic’s credit score, bolstering financial credibility and facilitating access to future credit with favorable terms.

In summary, refinancing and restructuring debt enables dental clinics to enhance their financial well-being, streamline operations, and promote long-term growth and prosperity.

Steps to Take When Considering Debt Restructuring

Managing debt through restructuring is a critical aspect of financial management that can lead to long-term success. However, it needs thoughtful consideration and strategic planning. Here are steps to navigate debt restructuring effectively:

- Evaluate your financial situation comprehensively, including outstanding loans, expenses, income, and cash flow.

- Define clear goals for restructuring, whether it’s to lower payments, reduce interest rates, or extend repayment terms.

- Explore available options such as debt consolidation, refinancing, or negotiation with creditors, understanding the pros and cons of each.

- Seek guidance from financial advisors or debt restructuring experts specialized in dental practices to make informed decisions.

- Develop a detailed restructuring plan encompassing financial projections, timelines, and contingency measures.

- Maintain open communication with creditors, providing necessary documentation and negotiating terms aligned with your goals.

- Implement the restructuring plan diligently, making necessary arrangements and monitoring progress closely.

By following these steps and seeking professional advice, dental practices can effectively manage debt, unlock financial success, and secure a stable future. It’s essential to recognize the power of managing debt to pave the way for improved financial well-being.

Steps to Consider When Refinancing Equipment and Other Purchases

Consider these steps when financing equipment and other purchases to ensure clarity and potential savings:

- Prioritize understanding the varied rates associated with financing options available to you.

- Seek detailed explanations of the rates and comprehend the monthly payment obligations.

- Explore the possibility of refinancing existing loans, especially if you’re not bound by terms, as low interest rates persist. For newer practices, after 1-2 years, refinancing could yield monthly savings.

- Take proactive measures to manage costly short-term debts, such as credit card debt. Consider leveraging equity in your practice or home at potentially lower costs, offering substantial savings in the long run.

Managing debt can be tough, especially for dental practices, but with the right strategies and knowledge, regaining control of your finances is possible. By exploring refinancing options and restructuring your debt, you can lower interest rates, improve cash flow, and ultimately achieve long-term financial stability. Remember, every dental practice is unique, so consider consulting with financial experts to determine the best approach for your specific situation.

Did You Know?

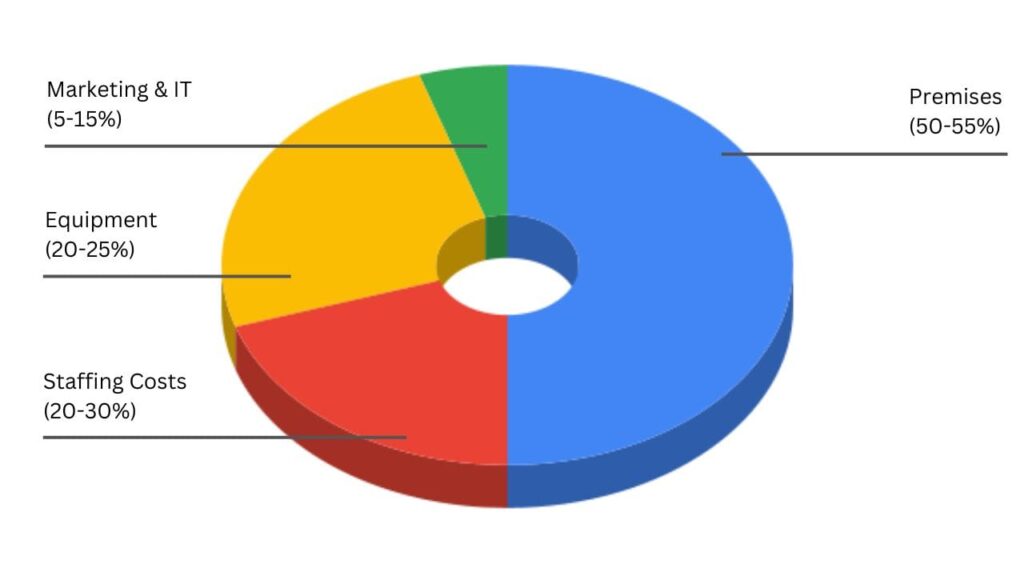

Dental Practice Operating Costs: Overheads range from 60% to 65% of revenue, mainly due to staff salaries, supplies, and office expenses. [ADA, 2021]

COVID-19 Impact: 76% of dental practices saw reduced patient visits post-pandemic, stressing financial health. [ADA Health Policy Institute, 2020]

Equipment Financing Rates: Interest rates as low as 4% for qualified borrowers, highlighting the need for competitive financing. [Bank of America Practice Solutions, 2023]

Learn more: Related Articles

About the Author

Neha Jain

Neha Jain is a skilled content writer with a rich background in business and financial knowledge. With a bachelor’s degree in English Literature and Psychology, Neha has honed her writing skills, furthering her expertise with the Content Writing Master Course (CWMC) at IIM SKILLS and a Content Marketing Certification from HubSpot Academy.

Working alongside our business development experts, Neha specialises in helping accountants, dentists and other healthcare professionals start, scale and sell their businesses.

Reviewed By:

Business Loans for Healthcare Businesses

We’ve been helping to fund the future of British healthcare businesses for over 20 years and our team are made up of former bankers with decades of experience in the UK’s healthcare lending sector.

You can find out more about working with Samera and the financial services we offer by booking a free consultation with one of the Samera team at a time that suits you (including evenings) or by reading more about our financial services at the links below.

For more information on raising finance for your healthcare business, including more articles, videos and webinars check out our Learning Centre here, full of articles and webinars like our How to Guide on Financing a Dental Practice.

Make sure you never miss any of our articles, webinars, videos or events by following us on Facebook, LinkedIn, YouTube and Instagram.