- Understanding the Importance of Accurate Payroll

- Understanding Payroll Basics

- The Role of HMRC in Dental Practice Payroll

- What are the Different Types of Employees in a Dental Practice?

- Calculating employee salaries and wages

- National Insurance Contributions (NICs) for Dental Practice Employees

- Understanding Auto Enrollment and pension schemes

- How to Handle PAYE and Tax Deductions

- Managing Employee Benefits and Expenses

- Outsourcing Payroll vs. In-House Management

- The Importance of Payroll Record-Keeping and Compliance

- How to Choose the Right Payroll Software for your Dental Practice

- Understanding Your Business Structure

- Paying Yourself as a Practice Owner

Running a dental practice is demanding. Between patient care, appointments, and managing staff, payroll can easily become an overwhelming task. With intricate regulations, constantly shifting tax laws, and the delicate balance between employee contentment and business profitability, it’s understandable that many dental practices find themselves grappling to meet their payroll responsibilities.

From deciphering the nuances of NHS pensions to following Auto Enrolment regulations, managing payroll can feel like walking a minefield. Payroll is more than simply writing out pay cheques and distributing them to your team. Payroll involves intricate regulations, employee classification, and meticulous record-keeping. Failing to navigate payroll correctly can result in costly errors, discontent among staff, and potential legal ramifications.

In this guide, we’ll break down everything you need to know about payroll so you can run your practice smoothly.

Understanding the Importance of Accurate Payroll

Managing payroll accurately is crucial for the success of any dental practice. It’s not just a matter of paying your employees on time, it’s also about fulfilling your legal responsibilities as an employer.

In the UK, HMRC scrutinises payroll accuracy closely, with even minor errors carrying the risk of substantial penalties and fines. Furthermore, errors in payroll can lead to disgruntled employees, denting morale, and productivity within your practice.

Imagine your diligent dental nurses or hygienists receiving incorrect pay slips or, worse yet, experiencing delays in payment. The repercussions can be extensive, impacting both employee contentment and your standing as a dependable employer.

Moreover, maintaining precise payroll is imperative for upholding compliance with UK employment laws, including Auto Enrolment, National Minimum Wage, and Statutory Payments.

Non-compliance with these regulations can result in severe financial penalties, legal repercussions, and tarnishing of your professional image. By ensuring accurate payroll management, you can sidestep these potential pitfalls and ensure your practice operates smoothly and legally. In doing so, you’ll be able to concentrate on your primary objectives – delivering exceptional patient care and advancing the growth of your practice.

Action Points:

- Conduct a Payroll Audit: Regularly review your payroll processes to ensure accuracy, identify errors, and make improvements. This helps maintain compliance and avoid penalties.

- Understand and Update Legal Knowledge: Stay informed about updates to UK employment laws affecting payroll, such as Auto Enrolment and National Minimum Wage. This knowledge is crucial for maintaining legal compliance. Full information can be found on the HMRC and Gov.uk websites.

- Implement Regular Payroll Reviews: Schedule regular reviews of your payroll system to adapt to legal changes and enhance accuracy. This proactive approach prevents discrepancies and ensures employee satisfaction.

Understanding Payroll Basics

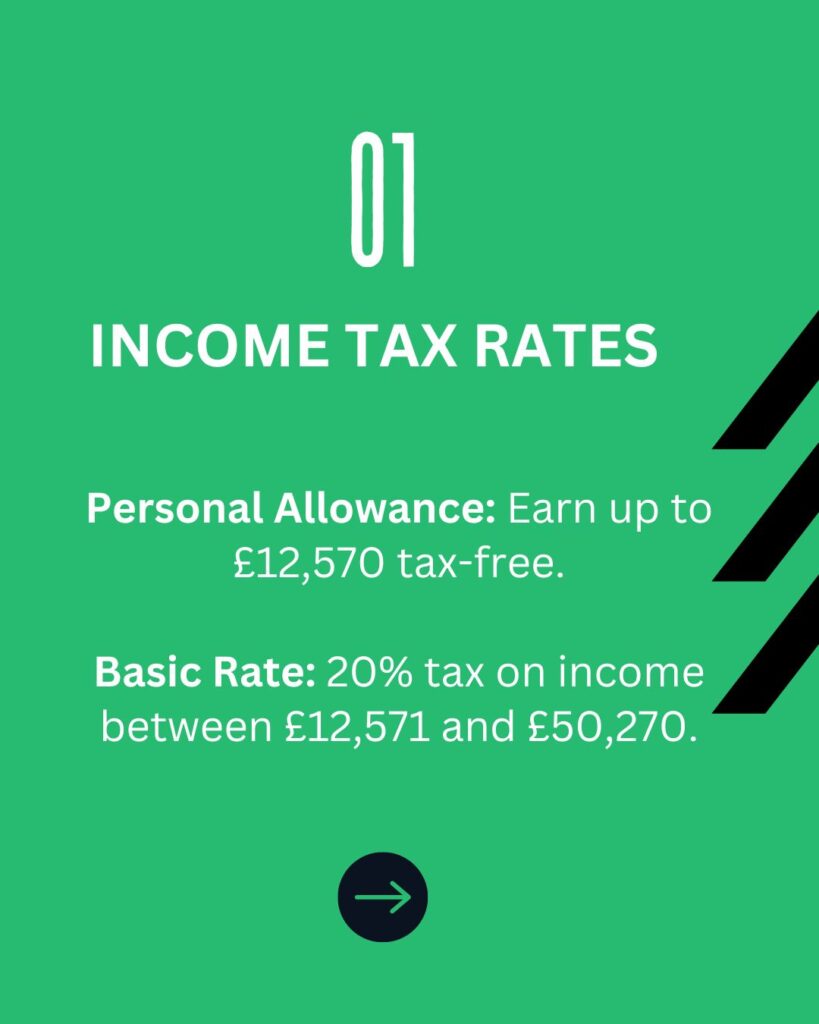

Understanding the basics of payroll is important for making sure your staff get paid correctly and on time. Firstly, you need to know the difference between gross pay, which is how much someone earns before deductions, and net pay, which is what they take home after deductions like tax and National Insurance.

It’s also important to understand common deductions, like money for pensions or paying off student loans, as well as any allowances they might be entitled to. You also need to think about how often you want to pay your staff, whether it’s every month or every two weeks, and what works best for your practice and your employees.

Action Points:

- Identify Common Deductions: Recognize common payroll deductions like pension contributions, student loan repayments, and others.

- Understand Allowances: Be aware of potential employee allowances that can affect pay.

- Determine Pay Frequency: Decide on a pay schedule (monthly, bi-weekly) that suits both your practice and your staff.

The Role of HMRC in Dental Practice Payroll

As a dentist, understanding the role of HMRC (Her Majesty’s Revenue and Customs) within your dental practice’s payroll operations is essential.

HMRC is responsible for the collection of taxes, including National Insurance contributions, income tax, and student loan repayments, deducted from employees’ wages. As the authority on the UK’s tax system, HMRC ensures that employers comply with the payroll regulations.

In dental practice payroll, HMRC provides essential guidance on payroll taxes, specifying the rates and thresholds for income tax, National Insurance, and student loan repayments. They also issue instructions on how to calculate and deduct these taxes from employee earnings and are responsible for collecting these payments. It is essential you understand these rules and regulations.

As a dental practice owner, it’s crucial you fulfil your HMRC obligations. This includes business registration, submission of tax returns, and punctual payments. Failing to comply with HMRC regulations can attract penalties, fines, and potential legal repercussions. By grasping HMRC’s role within your dental practice’s payroll ecosystem, you can avoid common pitfalls and ensure the smooth operation of your practice.

Action Points:

- Register with HMRC: If you haven’t already, ensure your dental practice is registered with HMRC. This is crucial for legal compliance and to enable you to start processing payroll.

- Stay Informed: Keep updated on the latest changes in tax rates, thresholds, and regulations from HMRC to ensure your payroll system remains compliant.

- Ensure Compliance: Strictly follow HMRC guidelines for calculating and deducting taxes from employees’ wages. This includes income tax, National Insurance, and student loan repayments.

- Timely Submissions and Payments: Set up a reliable system to submit accurate tax returns and make payments by the due dates to avoid penalties and ensure the smooth financial operation of your practice.

What are the Different Types of Employees in a Dental Practice?

In running a dental practice, it’s important to know the different employment types of people who work there. There are dental nurses, hygienists, associates, and receptionists, and each plays a big role in how well the practice runs. But what might surprise you is that each of these roles has its own rules and details when it comes to paying them.

In a dental practice, you might have different kinds of work arrangements. Some people work full-time, some part-time, some are hired on contracts, and others work as freelancers. Some might have hours that change, or they might only get paid based on how much work they do. It’s important to understand all these different types of employees so that you can follow the rules about paying them correctly. This includes things like figuring out taxes, making National Insurance contributions, and enrolling them in a pension scheme.

For example, do you know the difference between an employee and a worker? Or how to tell if someone is a self-employed contractor or a freelancer? Understanding these things can help you avoid making expensive mistakes and make sure you’re following the laws about employing people.

Action Points:

- Identify Staff Roles & Regulations: Be aware of the different dental practice staff roles (nurses, hygienists, associates, receptionists) and their specific pay regulations.

- Understand Employment Types: Recognize the various work arrangements (full-time, part-time, contract, freelance) and their impact on pay and benefits.

- Classify Employees Correctly: Differentiate between employees, workers, self-employed contractors, and freelancers to ensure proper classification for tax and benefit purposes.

- Comply with Employment Laws: Familiarize yourself with regulations regarding taxes, National Insurance contributions, and pension schemes for different employee types.

- Avoid Costly Errors: By understanding these classifications, you can avoid mistakes in payroll and ensure compliance with employment laws.

Calculating employee salaries and wages

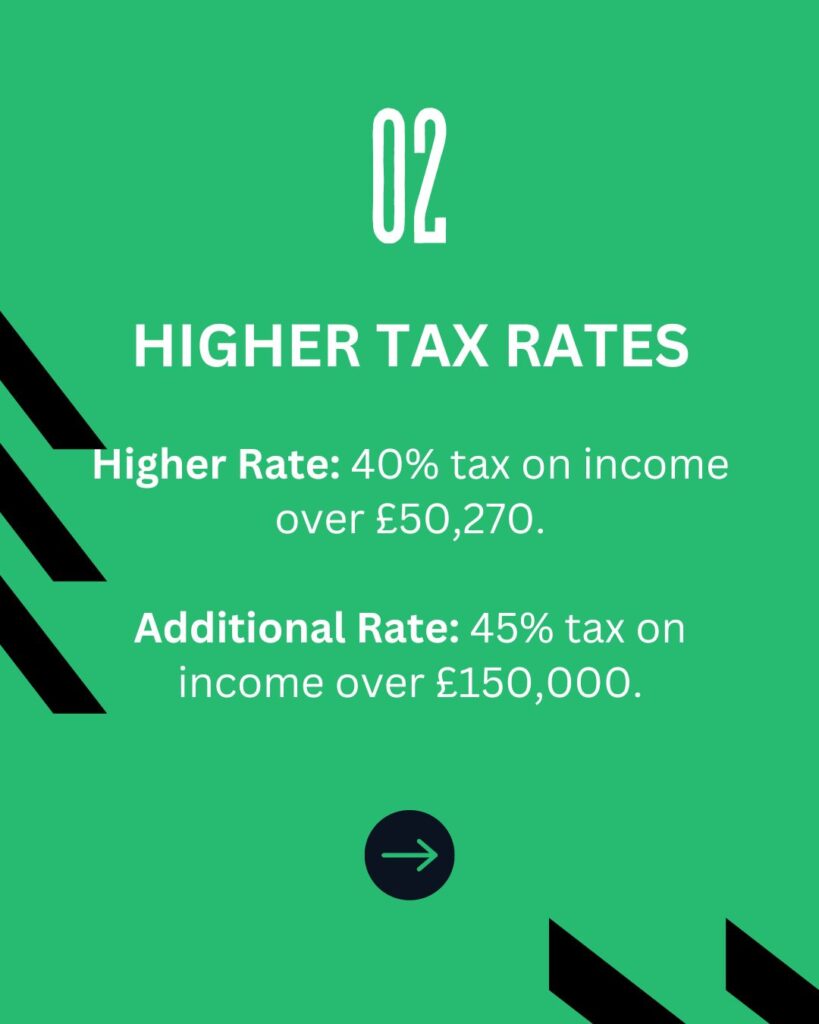

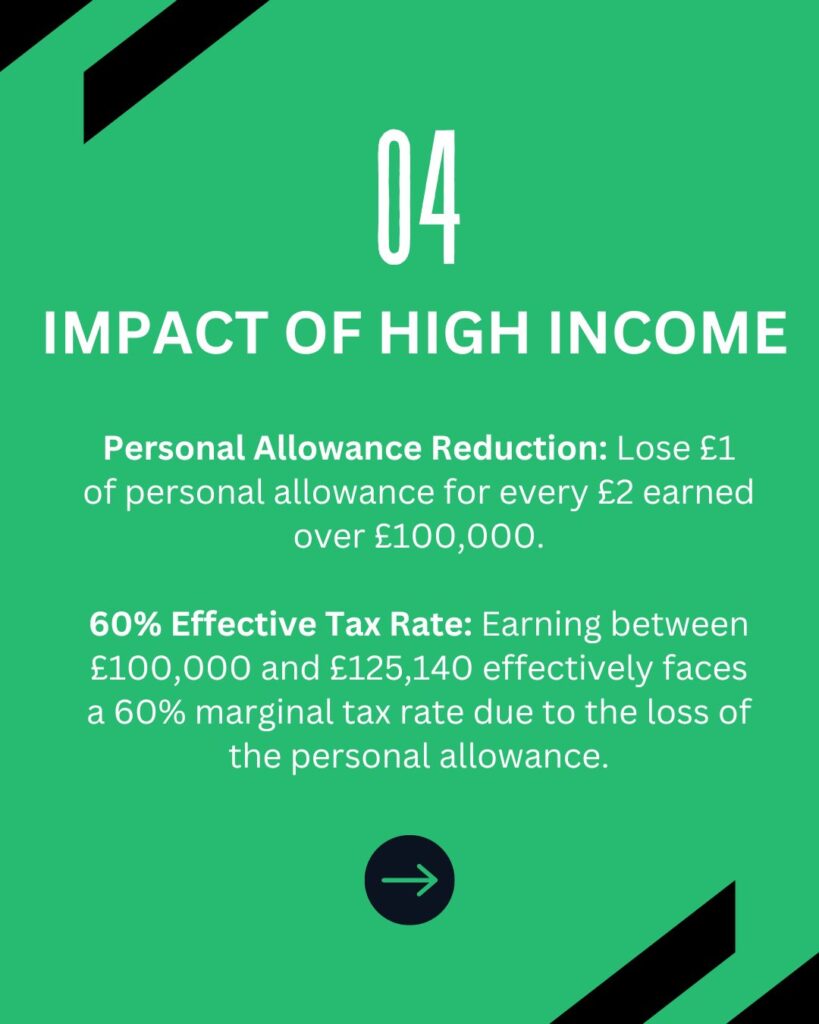

Deciding how much to pay your employees is an important part of managing payroll for dental practice owners. You must be really careful to get it right, so that you don’t make any mistakes that could upset your employees or get you into trouble with HMRC. When you work out how much to pay someone, there are lots of things to think about, like their basic pay, how much tax and National Insurance to take off, and any other deductions they might have, like student loan repayments or pension contributions.

To make sure you get it all right, you need to know all about the different tax rules and allowances that apply to the people who work for your dental practice. For example, you need to understand things like tax-free allowances for things like mileage or pension contributions, and make sure you use the right tax codes for each person.

You also need to keep up with any changes to tax rates or allowances, as well as any updates to the National Minimum Wage or National Living Wage. By carefully working out how much to pay your employees, you can make sure your dental practice follows all the tax laws and rules in the UK and keeps everyone happy and working well together.

Action Points:

- Research Tax & National Insurance: Thoroughly understand tax rules and National Insurance contributions for your dental practice employees.

- Factor in Allowances & Deductions: Consider tax-free allowances (mileage, pension contributions) and deductions (student loans) when calculating pay.

- Utilize Correct Tax Codes: Ensure you assign the appropriate tax code to each employee.

- Stay Updated on Regulations: Monitor changes in tax rates, allowances, National Minimum Wage, and National Living Wage.

National Insurance Contributions (NICs) for Dental Practice Employees

Being a dentist involves more than just looking after people’s teeth. You also have to deal with paying your staff and sorting out taxes. One important part of this is National Insurance Contributions (NICs), which can be really confusing for dental practice owners. NICs are a big part of what your employees get paid, and if you get them wrong, you could end up with fines and a bad reputation. By understanding how NICs work, you can make sure you pay the right amount, avoid mistakes, and keep your staff happy and motivated.

Action Points:

- Understand National Insurance Contributions (NICs): Gain a thorough understanding of how NICs work for dental practice employees.

- Prioritize Accurate NIC Payments: Ensure you pay the correct amount of NICs to avoid penalties.

- Minimize Payroll Errors: Understanding NICs helps prevent payroll mistakes and keeps employees satisfied.

Understanding Auto Enrollment and pension schemes

One important thing to remember when managing employees is setting up pension schemes through auto-enrolment. It’s important to get this right, not just to avoid fines but also to show your staff that you appreciate them and want to support their future.

Auto-enrolment is part of a government plan to encourage people to save for when they retire. As an employer, you have to provide a pension scheme for eligible staff. This means automatically signing up those who qualify for the scheme and making contributions to their pension pot. But don’t worry, it’s not as complicated as it sounds at first.

If you understand the basics of auto-enrollment, pension schemes, and your responsibilities as an employer, you can handle this part of managing payroll confidently, focusing on what you do best – giving great care to your patients.

Action Points:

- Implement Auto-Enrolment Pension Scheme: Establish a pension scheme for eligible dental practice staff.

- Auto-Enrol Qualifying Employees: Automatically sign-up staff who meet the eligibility criteria.

- Contribute to Employee Pension Pots: Make contributions towards employee retirement savings.

- Understand Auto-Enrollment Basics: Gain a basic understanding of auto-enrollment, pension schemes, and employer responsibilities.

How to Handle PAYE and Tax Deductions

Understanding how PAYE and tax deductions work is important when managing payroll, and it can be tricky, even for experienced dental practice owners. Your main job is taking care of your patients, not dealing with complicated tax rules and laws. But mistakes in this area can lead to fines, penalties, and a lot of stress. So, how can you make sure you’re getting PAYE and tax deductions right?

Firstly, it’s important to know that as an employer, you have to take Income Tax and National Insurance Contributions (NICs) from your employees’ wages using the PAYE system. This means working out how much tax to take off each person’s pay, based on their tax code and personal situation. It might seem simple, but it gets more complicated when tax rates, allowances, and reliefs change.

You also need to think about other deductions, like student loan repayments, pension contributions, and any court orders. And with Real Time Information (RTI), you have to report your payroll details to HMRC as it happens, so accuracy is really important.

Action Points:

- Grasp PAYE System: Understand the PAYE system for deducting Income Tax and National Insurance from employee wages.

- Calculate Accurate Tax Withholdings: Utilize tax codes and personal information to determine proper tax deductions.

- Stay Updated on Tax Changes: Monitor updates to tax rates, allowances, and reliefs.

- Consider All Deductions: Factor in student loans, pension contributions, and court orders when calculating deductions.

- Maintain Accurate & Timely RTI Reporting: Ensure precise and real-time payroll information is reported to HMRC.

Managing Employee Benefits and Expenses

Making sure that your employees get the right benefits and expenses is an important part of managing payroll, but it often gets overlooked. It’s important to offer good benefits to attract and keep the best people working for you, while also keeping an eye on costs to make sure your practice stays profitable. This includes things like pensions, life insurance, and extra perks for employees, such as gym memberships or help with childcare.

When it comes to expenses, you need to think about all the costs involved in running a dental practice, like buying equipment, getting supplies, and covering travel expenses. You also need to follow the rules from HMRC and make sure your employees are reimbursed correctly for any work-related costs they have.

To manage benefits and expenses well, you need to understand the rules about payroll and have a good system in place to keep track of everything accurately. If you do this properly, you can create a happy and rewarding workplace for your employees while also keeping your practice financially healthy.

Action Points:

- Offer Competitive Benefits Packages: Provide attractive benefits (pensions, life insurance) to recruit and retain top talent.

- Balance Costs & Benefits: Maintain a balance between offering desirable benefits and keeping practice finances healthy.

- Track Expenses Accurately: Implement a system to meticulously record all practice expenses (equipment, supplies, travel).

- Comply with Reimbursement Rules: Ensure employees are reimbursed correctly for work-related expenses according to HMRC guidelines.

Outsourcing Payroll vs. In-House Management

When it comes to managing your dental practice’s payroll, you have to decide whether to do it yourself or hire someone else to do it. Each option has its good points and bad points, so you need to think carefully about what’s best for you.

Managing payroll yourself might seem like the cheaper and more controllable option at first. But it can take up a lot of your time and resources. You’ll need to buy payroll software, make sure your team knows how to use it and keep up with all the rules, and spend time doing the payroll each month. You’ll also have to deal with any questions or mistakes that come up. And because the rules about payroll are always changing, it can be hard to keep up and make sure you’re doing everything right.

On the other hand, hiring a specialist payroll provider can take a lot of the pressure off you. These experts know exactly what they’re doing and have all the right tools to get the job done accurately and on time. They’ll make sure you follow all the rules and that your employees get paid correctly. They can also give you advice on tricky payroll issues, like setting up pensions or dealing with student loan payments. By outsourcing your payroll, you can free up your time to focus on what you do best – looking after your patients and growing your dental practice.

Action Points:

- Evaluate Payroll Management Options: Consider both in-house and outsourced payroll management.

- Assess In-House Payroll Challenges: Be aware of the time commitment, software costs, training needs, and regulatory updates associated with managing payroll internally.

- Recognize Benefits of Outsourcing Payroll: Understand the advantages of using a payroll provider, including expertise, accuracy, time savings, and access to expert advice.

The Importance of Payroll Record-Keeping and Compliance

As a dentist, you know how important it is to keep careful records in your practice. From notes on patients to plans for treatments, every little detail matters. The same goes for keeping records of your payroll and following the rules.

It’s important to keep accurate and detailed records to make sure you’re following the law as an employer and that your staff get paid correctly. HMRC says that employers have to keep good records of how much their employees earn, what tax is taken off, and any national insurance contributions. If you don’t follow these rules, you could end up with fines or legal problems. Plus, if your record-keeping isn’t up to scratch, you might make mistakes when paying your staff, which could affect your practice’s money and reputation.

By keeping careful records of your payroll, you can make sure you’re following all the laws, like the National Minimum Wage and rules about working hours and pensions. Good records also make it easier to give your staff the right information when they ask and help you make smart decisions about things like hiring and how to use your resources.

There are lots of tools and software available to help you keep track of your payroll and follow the rules. From online systems to programs that do reports for you, there are plenty of options to make managing your payroll easier. By using these tools, you can reduce the risk of making mistakes and save time.

Action Points:

- Maintain Accurate & Detailed Payroll Records: Ensure comprehensive records on employee earnings, tax deductions, and National Insurance contributions.

- Comply with HMRC Regulations: Adhere to HMRC guidelines for payroll record-keeping to avoid legal issues and fines.

- Prevent Payroll Errors: Accurate records minimize the risk of employee pay mistakes, protecting your practice’s finances and reputation.

- Payroll Tools & Software: Explore online systems and reporting software to streamline record-keeping and reduce errors.

How to Choose the Right Payroll Software for your Dental Practice

Choosing the right payroll software for your dental practice is a big decision. It can make things run smoother, cut down on mistakes, and make sure you’re following the rules from HMRC. But with so many options out there, it can be hard to know which one is best for your practice.

When you’re looking at payroll software, there are a few important things to think about. First, it should be easy to use, with a simple layout that anyone can understand, no matter how much they know about payroll. It should also have features that automate tasks, so you don’t have to spend ages doing things manually. And it needs to be able to grow with your practice, so it can handle changes like hiring more staff or changing how much people get paid.

It’s also important that the software works well with any other systems you already use, like your practice management software. This makes it easier to transfer data between them and reduces the risk of mistakes. And having real-time reporting features is a big plus too, because it means you can see how your practice is doing financially whenever you need to.

Action Points:

- Prioritize User-Friendliness: Select software with a simple and intuitive interface for ease of use.

- Automate Tasks: Opt for software with features that automate payroll processes to minimize manual work.

- Scalability: Choose software that can adapt to growth, accommodating additional staff or changing pay structures.

- Integration: Ensure compatibility with existing practice management software to facilitate data transfer and reduce errors.

- Real-Time Reporting: Prioritize software with real-time reporting functionalities.

Understanding Your Business Structure

Understanding the different types of business structures is important for managing your finances properly.

If you’re a sole trader, you’re in charge of everything, but you’re also personally responsible for any money the business makes or loses. You’ll need to fill in a Self-Assessment tax return each year, which includes income tax and Class 2 NICs on your profits.

If you’re in a partnership, you and your partners share the money the business makes or loses based on what you’ve agreed. Each partner pays tax and Class 2 NICs on their share of the profits.

If you have a limited company, your personal money is separate from what the business makes. You’ll get paid a salary and might also get dividends, which have different tax rules. The company pays Corporation Tax on its profits, and has to pay Employer’s NICs.

Action Points:

- Identify Business Structure: Understand the financial implications of your chosen business structure (sole trader, partnership, limited company).

- Sole Trader Taxes: Be aware of personal responsibility for business finances and the requirement to file Self-Assessment tax returns (income tax & Class 2 NICs).

- Partnership Taxes: Recognize shared responsibility for profits/losses with partners and individual tax obligations based on profit share (income tax & Class 2 NICs).

- Limited Company Taxes: Distinguish between personal income (salary/dividends) and company profits. Salary and dividends have separate tax implications.

- Company Tax Obligations: The company is liable for Corporation Tax on profits and Employer’s NICs.

Paying Yourself as a Practice Owner

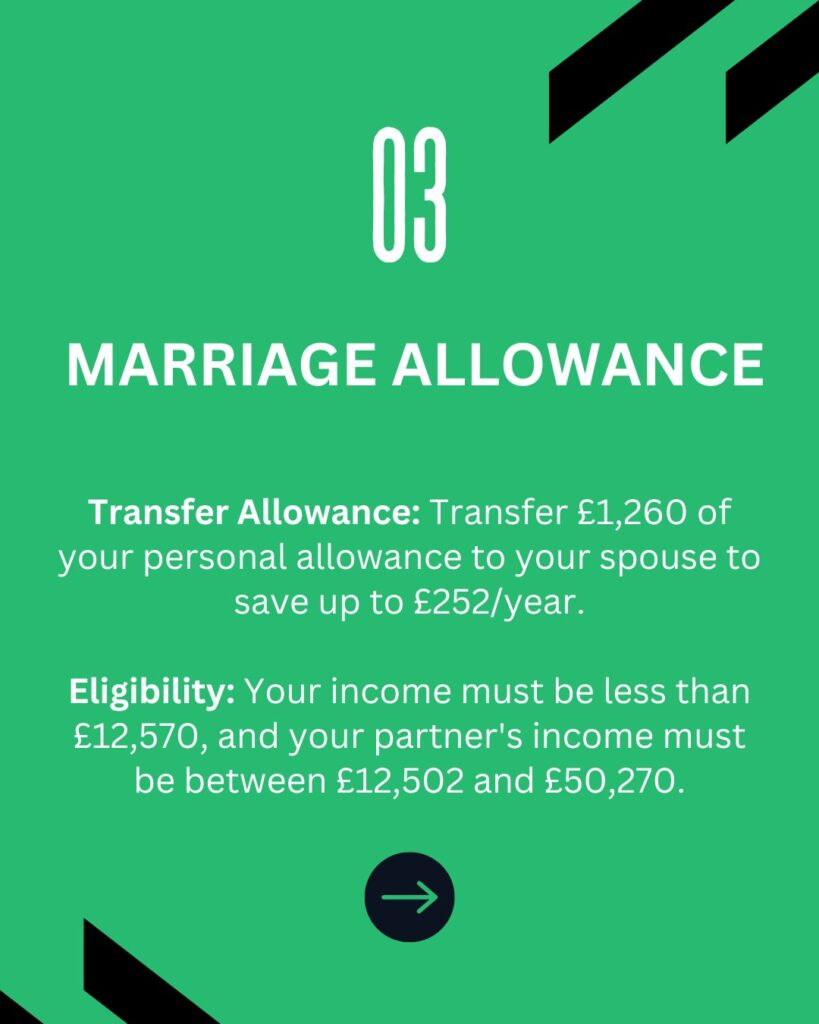

Deciding how to pay yourself as a practice owner involves thinking about a few things. Firstly, you need to consider what’s fair for you and how much money the practice can afford to pay you. Then, you might want to think about whether to pay yourself through a salary or dividends.

If you pay yourself a salary, you’ll have to pay income tax and National Insurance on it, but you can also make contributions towards your pension. On the other hand, if you pay yourself dividends, you might pay less tax overall, but it depends on how much profit the practice makes and your personal tax situation. It’s important to get advice from a professional accountant to make sure you’re making the best choice for you and your practice.

Action Points:

- Balance Fair Pay & Practice Affordability: Determine a salary that is fair for your contributions while considering the financial health of the practice.

- Salary vs. Dividends: Evaluate the pros and cons of paying yourself through salary (income tax & National Insurance but allows pension contributions) or dividends (potentially lower tax but depends on profits and personal tax situation).

- Seek Professional Advice: Consult with an accountant to determine the optimal compensation strategy for you and your practice.

Dental Accounts & Tax Specialists

As dental practice owners ourselves, we know what makes a clinic tick. We have been working with dentists for over 20 years to help manage their accounts and tax.

Whether you’re a dental associate, run your own practice or own a dental group and are looking to save time, money and effort on your accounts and tax then we want to hear from you. Our digital platform takes the hassle and the paperwork out of accounts.

To find out more about how you can save time, money and effort on your accounts and tax when you automate your finances with Samera, book a free consultation with one of our accounting team today.

Dental Accounts & Tax: Further Information

Make sure you never miss any of our articles, webinars, videos or events by following us on Facebook, LinkedIn, YouTube and Instagram.

Reviewed By: